In recent years, the concept of being child-free has shifted from a niche lifestyle choice to a mainstream trend. As more individuals and couples opt out of parenthood, the implications of this decision extend beyond personal preferences and values; they also significantly impact financial planning and lifestyle. For many, identifying as a “childless cat lady” is a proud declaration of independence, self-sufficiency, and financial freedom. But what does it mean for your finances?

1. Financial Flexibility and Discretionary Spending

One of the most apparent financial benefits of being child-free is the increased discretionary income. Without the financial obligations that come with raising children—such as daycare, education, healthcare, and extracurricular activities—those who choose to remain childless often find themselves with more disposable income. This financial flexibility allows for a lifestyle focused on personal interests, travel, hobbies, and investments. Whether it’s splurging on a luxury vacation, upgrading living conditions, or indulging in the latest tech, the options are plentiful.

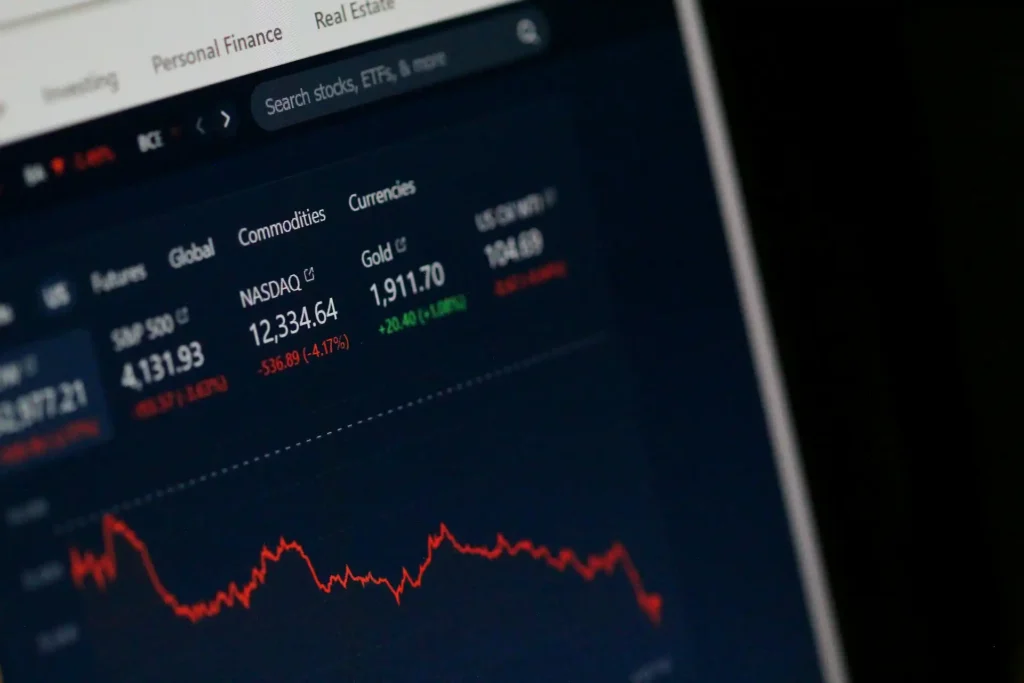

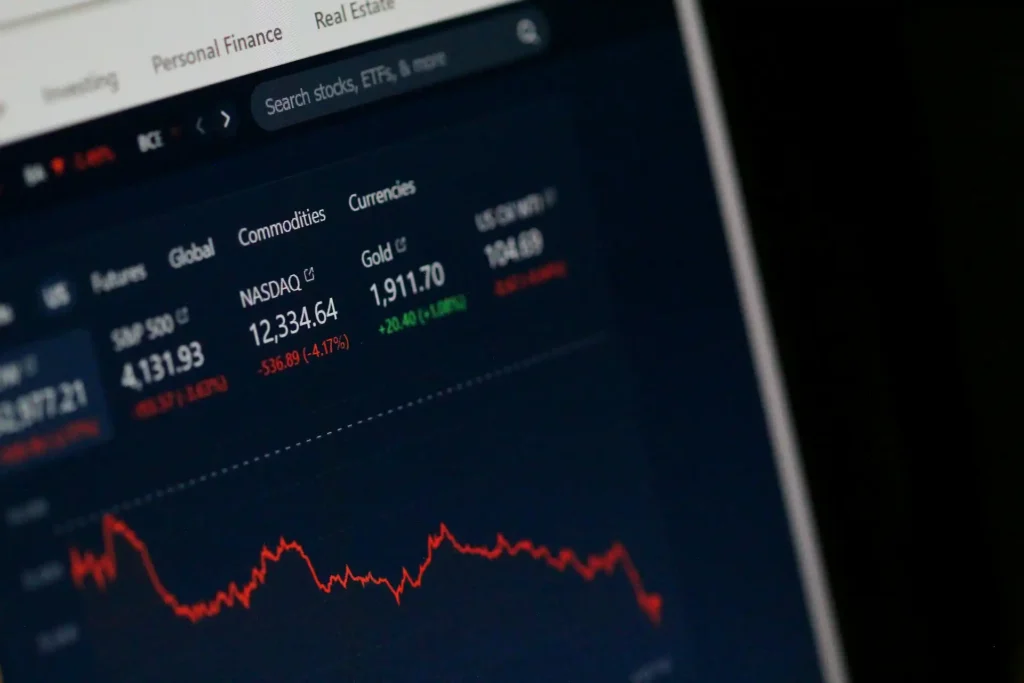

2. Savings and Investments

Being child-free can also facilitate a more robust savings and investment strategy. With fewer financial commitments, individuals have the opportunity to allocate funds toward retirement accounts, emergency savings, and investment portfolios. This proactive approach to personal finance can lead to increased wealth accumulation over time. Child-free individuals may choose to invest in real estate, stocks, or even startups, thereby diversifying their income sources and enhancing their financial security.

3. Lifestyle Choices and Cost Considerations

Living child-free often translates to lifestyle choices that can significantly affect financial planning. For example, many child-free individuals prioritize experiences over material possessions, which can lead to spending patterns that favor travel, dining, and entertainment. While these expenditures can be fulfilling, they require careful budgeting to ensure long-term financial health.

Additionally, the choice to be child-free might involve living in urban areas where the cost of living is higher but lifestyle options are abundant. Understanding the balance between enjoying the present and planning for the future is crucial for maintaining financial well-being.

4. Insurance and Healthcare Costs

Another financial aspect to consider is health insurance and medical expenses. Child-free individuals might prioritize their health coverage, focusing on preventative care and wellness without the added costs associated with dependents. However, it’s essential to recognize that with aging, healthcare costs can increase. Planning for health insurance and potential long-term care becomes vital for financial security.

5. Estate Planning and Legacy Considerations

For those who are child-free, traditional estate planning may look different. Without children to inherit assets, individuals may choose to designate beneficiaries among relatives, friends, or charitable organizations. This approach can lead to unique legacy planning strategies that reflect personal values and priorities. Child-free individuals might also consider creating trusts or establishing foundations to support causes they are passionate about.

Conclusion: Embracing Financial Independence

Being a “childless cat lady” or choosing to live a child-free lifestyle comes with distinct financial implications. From enhanced discretionary income to flexible spending and investment opportunities, the choice to remain child-free can lead to significant financial freedom. However, it also requires thoughtful planning and consideration of future needs, particularly regarding healthcare and legacy. Ultimately, embracing this lifestyle allows for a fulfilling life that reflects personal choices and values, all while navigating the financial landscape with independence and confidence.

4o mini